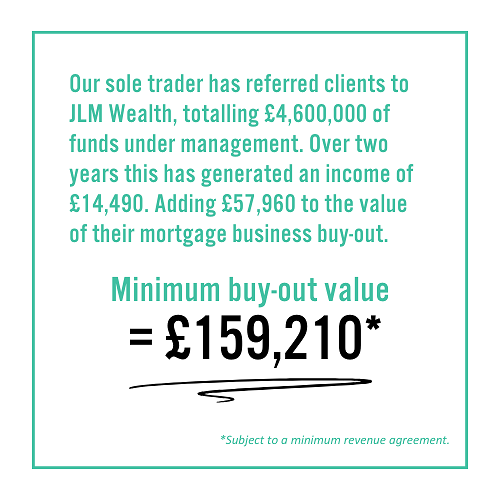

See How It Works In Practice

Our buy-out and succession planning model goes further by offering the opportunity to build additional value into your business.

This includes access to JLM Wealth, allowing your business to become more than just a mortgage intermediary — it becomes a wider distribution channel.